2021-03-27

Looking back to this turbulent year of 2020, the biggest question in everyone’s mind should be: “Why does the U.S. stuck in a dilemma of COVID-19?” It is the most powerful country in the world since the World War II, but why is it the country that most suffered in the COVID-19, even with the strongest government and the most advanced technological talents? As at 9th March, 2021, accumulated number of confirmed cases of COVID-19 in the U.S. has reached 29.86 million. Even though it is only accounted for 4% of the total global population, but the number of cases accounts for more than 25% and the number of deaths exceeds 20% in the world. As a result, think-banks and social media around the world are beginning to doubt whether the once powerful U.S. is failing or not.

The Beginning of Fall of the U.S. Power: Social Division

From the inauguration speech of Biden, we can find relevant clues. Biden mentioned that “few periods in our nation’s history have been more challenging or difficult than the one we are in now. A once-in-a-century virus has taken countless lives and millions of jobs have been lost, as well as a rise in political extremism, white supremacy and domestic terrorism.” “Unity” is the keyword in this Biden’s speech: “This is our historic moment of crisis and challenge, and unity is the path forward.” So, the question is: “Why is the U.S. not being united?”

The root cause of disunity of the U.S. is structural unemployment. Since 2000, the technological change and globalization wave have led to the loss of numerous jobs of the U.S. workers. This kind of structural unemployment has led to an increase in the gap between rich and poor, and thus causing the rise of populist politics. Trump’s incitement has further ignited the potential values division and social antagonism. As a result, the U.S. becomes disunited. As such, disunity has led to a decline in the government’s ruling efficiency and an inability of concentrating the public forces, which are clearly demonstrated in this pandemic. However, China has made joint efforts of the government’s efficient resources allocation and the high unity among the public, resulting in the growth and decline of the national strength between China and the U.S. Therefore, structural unemployment threatens the position of the U.S. to be the most powerful country, and the U.S. government must first tackle this root cause.

Solution to the U.S.: Solving Structural Unemployment

From the perspective of “solving structural unemployment”, we can then understand why the Federal Reserve introduced the unprecedented unlimited quantitative easing in 2020, and proposed the “Average Inflating Targeting” which changed the monetary policy framework of the Federal Reserve in the past 40 years. At the same time, the U.S. Treasury Department has approved unprecedented large-scale economic relief measures, and will further introduce a larger scale of infrastructure projects. The purpose of all policies is to take “employment” as the highest guiding principle so as to solve the structural unemployment. By then, the U.S. can become great again, and thus consolidate its position as the world’s largest power.

(A) Monetary Policy: Maintaining Long-term Easing to Create An Economic Environment for Employment

After the financial market showed signs of liquidity crisis in March 2020, the Federal Reserve quickly cut interest rates to zero interest rates and started unlimited quantitative easing. Also, it launched various emergency loan plans in 2008, and announced a series of new financing tools in cooperation with the Treasury Department (such as commercial paper financing tools and Primary Market Corporate Credit Facility). The assets of the Federal Reserve increased by nearly $3 trillion in three months, but it took five years to reach this scale after 2008 financial crisis. No matter from the speed of cutting interest rate, QE rhythm or tool type, this monetary policy easing is unprecedented. However, these measures are more focusing on resolving the relief than stimulating the employment.

More importantly, the Chairman of the Federal Reserve Powell announced at the Jackson Hole Global Central Bank Annual Meeting held on August 27, 2020 that he would adopt the “Average Inflation Targeting” policy, that is, “seek to achieve an average inflation rate of 2% and agree that if the inflation rate is lower than 2% for a period of time, it will still keep the inflation rate higher than 2% for a period of time.” However, the Federal Reserve is not a hurry to change the monetary policy immediately because “the decision of the monetary policy will be based on employment maximization.” This means that the Federal Reserve will sacrifice some inflation space in exchange for creating more jobs, which downplays the importance of Phillips curve. This shows a transformation of the Federal Reserve’s monetary policy framework since 1980s, meaning that it will no longer focus on “suppressing inflation”. Its purpose is to maintain loose monetary policy as much as possible and provide the most appropriate environment for employment creation.

So, how long will the extremely loose monetary policy last? The exit of the extremely loose monetary policy can be divided as two stages: a reduction in QE (taper) and an increase in interest rates. Taper may begin in the first half of 2022. In the Minutes of December 2020, the Federal Reserve announced for the first time that “some officials believe that as long as the Federal Reserve’s employment and inflation target have achieved a substantial improvement, it can start to reduce its debt purchases gradually.” According to the current conversation of the Federal Reserve’s officials, all of them basically do not intend to start the taper before 2021, and will communicate with the market in advance.

Coming to the increase of interest rate, according to the bitmap released by the Federal Reserve at its interest rate meeting in March, there will be no interest rate increased at least until 2023. Besides, with the fluctuation of the bond market and the market’s optimistic expectation of an early increase in interest rates, the U.S. Federal Reserve Chairman Powell reaffirmed the attitude of the policy dove of not raising interest rates until the conditions are met, and stressed the position that “the 4% unemployment rate is a good target, but there is still a long way to go to reach the maximum employment target”. The minutes of the Federal Reserve in January 2021 also pointed out that “if the large number of workers who have left the labor force reported since the pandemic are counted as unemployed, the unemployment rate should be increased significantly.” This means, apart from restoring the unemployment rate to pre-recession level, the Federal Reserve also hopes a rebound of the labor force, allowing people who quit the labor market due to structural unemployment can be recruited again.

However, depending solely on the monetary policy is insufficient to tackle the structural unemployment effectively. On February 11, 2021, Powell called on the government to increase its financial support to the economy in his speech because “it is difficult for the monetary policy to restore the full vitality of the labor market solely”. At the same time, the U.S. Treasury Secretary Yellen also called for a massive stimulus package to restore full-scale economic growth on February 18, 2021 because “the consideration of doing too little is much higher than that of doing too much”. These speeches highlight a shift in thinking among the U.S. policymakers as they have learnt from the lesson of “inadequate policy measures” would lead to the long-term economic weakness since 2008 financial crisis. Apart from maintaining a longer loose monetary policy, it is more important to solve the structural unemployment by introducing fiscal policies.

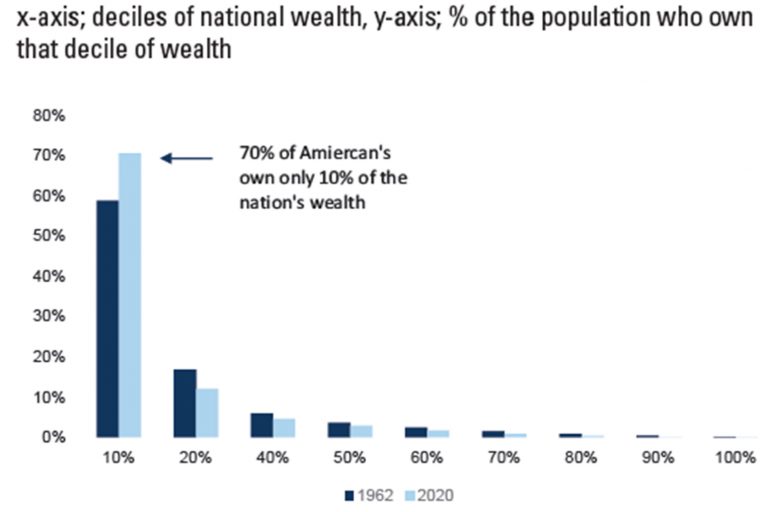

As Goldman Sachs pointed out in its 2021 Annual Outlook, the monetary-oriented stimulus of the past ten years has been confined to the banking system, benefiting only the high-income group, whose marginal propensity to consume is only 3%. In contrast, average consumption tendency of the low-income household is 95-105%. Since majority wealth in the U.S. is held by a minority, there is not much additional demand for the economy from the overall wealth growth. Also, COVID-19 will be the catalyst of a new era. Since the Federal Reserve’s announcement of a new policy framework pointed out “the strong cyclical economic sectors have solved many political issues such as inequality, climate change and structural unemployment”, the focus of global policies will shift from financial stability to social needs so as to address these political issues that can no longer be ignored.

History showed that the economy must overheat so as to solve the social problems of income inequality and unemployment among ethnic minorities, because the wages of low-income earners have the fastest growth and can effectively narrow the gap. In fact, from Biden’s fiscal strategy and Johnson’s “upgrade” agenda in UK, to Europe’s years fiscal frameworks and China’s five-year-plans, redistribution policy has become the core of the long-term agenda of global policymakers. Even though COVID-19 will eventually disappear, the redistribution policy will still continue in the 2020s.

(B) Fiscal Policy: “Doing too little is more costly” – Creating employment in the U.S. through re-industrialization

Under the principle of “the consideration of doing too little is much higher than that of doing too much”, the U.S. Treasury Department has successively introduced a series of fiscal stimulus bills since March 2020. By March 2021, the accumulate scale exceeded $6 trillion, which was more than three times higher than the scale of the 2008 financial crisis. However, regarding the financial items, the purpose of these bills is to “prevent disadvantages” rather than “promote profits”. Since most of the funds are used for corporate loan assistance, unemployment relief and cash cheques, medical care expenditure, etc., the main purpose is to fill the gap in economic activities rather than stimulate economic growth. Therefore, the current fiscal bill belongs to the first stage of “prevent disadvantages” policy for avoiding a higher job loss. To fill the gap of structural unemployment, the second stage of “promote profits” is more important, which is to create more employment opportunities for the U.S. manufacturing sector through re-industrialization.

Upon the establishment of the $1.9 trillion “American Rescue Plan”, the Biden’s government will focus on the second stage economic plan by aiming at the long-term development policy of infrastructure and green energy transformation. Bloomberg pointed out that the scale and complexity of Biden’s next economic recovery plan will far exceed this rescue plan which costs $1.9 trillion. The recovery plan may be the largest infrastructure plan in the U.S. since The New Deal. During the election in July 2020, Biden has once suggested an infrastructure plan with green energy costing a total of $2 trillion. It mainly consists of four major areas, namely green infrastructure, traditional infrastructure, fair infrastructure and infrastructure that made in the U.S. With green infrastructure, the U.S. economy can establish a green manufacturing chain to provide additional employment opportunity for the U.S. workers; while with traditional infrastructure and fair infrastructure, effectiveness of the U.S. commercial activities can be boosted to create jobs for having a better environment to attract foreign investment.

Finally, due to the shortage of materials faced by the U.S. in this pandemic, Biden will build an exclusive supply chain for the U.S. to ensure its national security and create new employment opportunity for the U.S. manufacturing industry. On February 24, 2021, Biden signed an executive order to undertake a 100-day review among four major products, namely semiconductors, electric vehicle batteries, rare-earth elements and pharmaceuticals, so as to tackle the problem of supply chain by promoting domestic production in the U.S. Biden also mentioned that the second executive order will commence a one-year review among six industries (namely national defense, public health, communications, energy, transportation and food) for identifying available policies to strengthen the supply chain.

Among them, take the most important product, semiconductors, as an example. According to the statistics of the Semiconductor Industry Association, the sales volume of the U.S. semiconductors’ companies accounts for 47% of the current global sales of chips. However, only 12% was made in the U.S. in 2018, which was declined sharply compared to that of 37% in 1990. On March 1, 2021, the new U.S. trade representative, Katherine Tai, said that “she would work to fight a range of ‘unfair’ Chinese trade and economic practices and would seek to treat Chinese censorship as a trade barrier”. This indicates the U.S. will not stop its blockade of China’s semiconductor development. At the same time, the Biden administration also wants to expand domestic production capacity in the U.S. A recent internal letter from Taiwan Semiconductor Manufacturing, the world’s largest wafer manufacturer, pointed out that apart from the scheduled Arizona plant, it will also expand to six “mega-wafers” in the U.S. in the future.

In fact, the Biden administration’s proposal to establish a green energy industry, upgrade infrastructure and strengthen supply chains is a continuation of Obama’s “re-industrialization” concept in 2009. At that time, measures such as the “National Export Initiative” and the “Manufacturing Enhancement Act” are proposed to strengthen the role of export and manufacturing industry. By recovering the real economy from different sectors such as the manufacturing industry, the U.S. can consolidate the global leading position of some industries. In this case, being the Vice President and working with Obama at that time, Biden is reasonable to continue his previous policy in this moment. While learning a lesson from last time, he will promote the re-industrialization policy more strategic and targeted this time so as to solve the structural unemployment and thus making the U.S. great again. Ten years ago, the Obama’s administration promoted Shale Oil and Gas Energy Policy; while ten years later, Biden’s administration promotes Clean Energy Policy. At the same time, coupling with the upgrade of the U.S. infrastructure and the commencement of a new era of the global technological innovation, will the U.S. also enter a new era?

華人家族傳承研究中心

商學院, 香港恒生大學

香港 新界 沙田 小瀝源 行善里

電郵: cfsrc@hsu.edu.hk 電話: (852) 3963 5588

© 2020 香港恒生大學 版權所有 |

私隱政策

Chinese Family Succession Research Centre

School of Business, The Hang Seng University of Hong Kong

Hang Shin Link, Siu Lek Yuen, Shatin, N.T., Hong Kong

Email: cfsrc@hsu.edu.hk Tel: (852) 3963 5588

© 2020 The Hang Seng University of Hong Kong. All Rights Reserved |

Privacy Policy